The justices seemed split over whether presidents need immunity protection from political prosecutors or if the country needs protection from criminally immune presidents.

David Pecker says Trump refused to reimburse him for covering up McDougal's story.

Spanish authorities are investigating the business dealings of the wife of Socialist Spanish Prime Minister Pedro Sánchez. He calls the corruption claims baseless, accusing right-wing opponents of persecution to derail his progressive agenda.

Facebook processes years' worth of personal data for advertising purposes. The lucrative business model suffered a blow after an EU court adviser found it violates EU privacy rules.

Closing Arguments

A roundup of our top stories, delivered Fridays to your inbox.

Subscribe for free here!The state's high appeals court ordered a new trial for Weinstein in part because a judge allowed women to testify about other uncharged sexual assaults and "prior bad acts" at his 2020 trial.

Podcast

Advocates of the Sacramento-San Joaquin River Delta say preparing levees — which protect more than 600,000 residents and about 740,000 acres of land — is critical in the face of climate change.

Courts & the Law

“Mr. Trump’s continued defamation of Ms. Carroll — even during the course of trial — in turn warranted a finding that he would not stop attacking Ms. Carroll unless faced with a significant deterrent, a critical function of substantial punitive damages awards," the judge found.

Alaska claims the federal government failed to consider its economic interests on the North Slope when designating critical habitat the size of Texas.

Under the terms of the settlement, the for-profit University of Phoenix and its parent company would pay $4.5 million and take responsibility for unlawfully soliciting service members on military sites.

The men face charges of attempting to illegally export a semiconductor machine to China.

Around the Nation

Two incumbents who stepped down and a third who left her intentions unclear for months led to wide-open races in Republican strongholds.

Two types of snapping turtle, the white-tailed ptarmigan and the Peñasco least chipmunk are among the species that will receive protection decisions by the end of the year.

The university found student protestors in violation of a school policy on Thursday — one Northwestern officials only enacted that morning.

The states claim the employment commission added abortion-related requirements that were never part of the bipartisan Pregnant Workers Fairness Act.

Residents at the decade-old encampment worried city officials would throw out their belongings, leaving them in an even more precarious state.

Assemblymember Vince Fong, the author of the bill that responds to "Paneragate," said he was frustrated by the process.

Rulings

A federal court in Maine dismissed all claims brought against the town of Westbrook and several of its officials, who were sued by a former employee for sex discrimination. His supervisor allegedly treated him differently not because he was a man, but because he replaced the supervisor’s paramour, which would not constitute sex discrimination if true.

A federal court in Texas allowed an investor to proceed with his claims, arising from his purchase of $15 million in fraudulent certificates of deposit from a broker that participated in the scheme. The claims are not time-barred, the court ruled, and the genuine fact issues must be settled as the case proceeds.

The Pennsylvania Superior Court upheld the sentencing of a criminal defendant who formed his hand in the shape of a gun and pointed it at a testifying witness during trial. The court had enough evidence to convict him of criminal contempt.

The Fifth Circuit reversed a Texas federal court’s dismissal of a disabled Black employee’s retaliation and discrimination claims against Navarro County, where he worked in the drug trafficking division. He was in remission from cancer that was treated with throat surgery, so he asked to work remotely in 2020 to avoid contracting Covid-19, but his supervisor denied this and he was placed on leave after complaining about it. The lower court erred in determining the employee hadn’t produced enough evidence of his claims.

A federal court in New York preserved the false-advertising class action brought against the makers of Kerrygold Irish Butter, which allegedly misled consumers about the presence of per- and polyfluoroalkyl substances (PFAS), also known as “forever chemicals,” in the product’s packaging — and which can seep into the food itself. The court says a reasonable consumer would perceive the products as not containing harmful chemicals based on the “Pure Irish Butter” labeling.

From the Walt Girdner Studio

Hot Cases

Hunter Biden filed an interlocutory appeal with the Ninth Circuit on Friday, arguing a federal judge improperly rejected his bid to dismiss tax evasion charges because a plea agreement barred the special counsel from charging him.

Airline passengers and former travel agents seek to stop Alaska Airlines from acquiring Hawaiian Airlines Inc., saying the deal creates a monopoly, shrinks competition in multiple passenger airline markets and threatens Hawaii's economy.

Popular Lunchables meal kits contain lead, cadmium and phthalates, two mothers say in a class action that accuses Kraft Heinz of deceiving customers. A recent report showed that Lunchables — often consumed by children — contained over 60% of the maximum allowed levels of the toxic chemicals that can cause brain damage and other health issues.

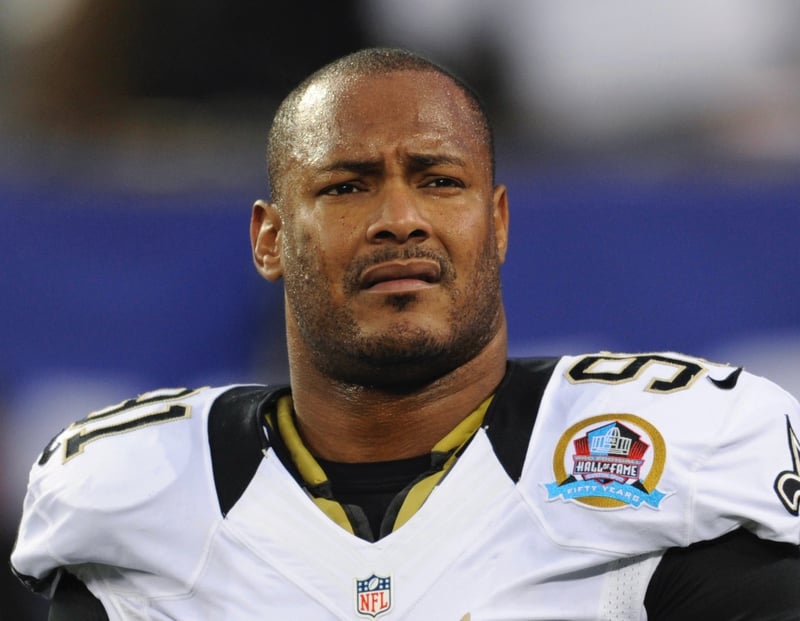

Mike Tyson punched out a fellow JetBlue passenger after he declined the former heavyweight boxing champ's offer of magic mushrooms on the flight, the passenger says in a lawsuit that looks to also hold the airline accountable for Tyson's behavior.

Those who are arrested in Travis County aren't provided counsel for initial bail hearings, one arrestee says in a class action that accuses the county of creating a "two-tier" system that favors those who can afford to hire an attorney.

More News

Places