WASHINGTON (CN) — In a move that could result in the breakup of Google’s colossal advertising business, the Biden administration brought a massive antitrust lawsuit Tuesday that accuses the tech giant of crafting a “monopolistic grip” over the U.S. digital advertising industry for the last 15 years.

“Google has engaged in exclusionary conduct that has severely weakened, if not destroyed competition in the ad tech industry,” Attorney General Merrick Garland said at a press conference in Washington this afternoon where he announced the complaint against Google in Alexandria, Virginia.

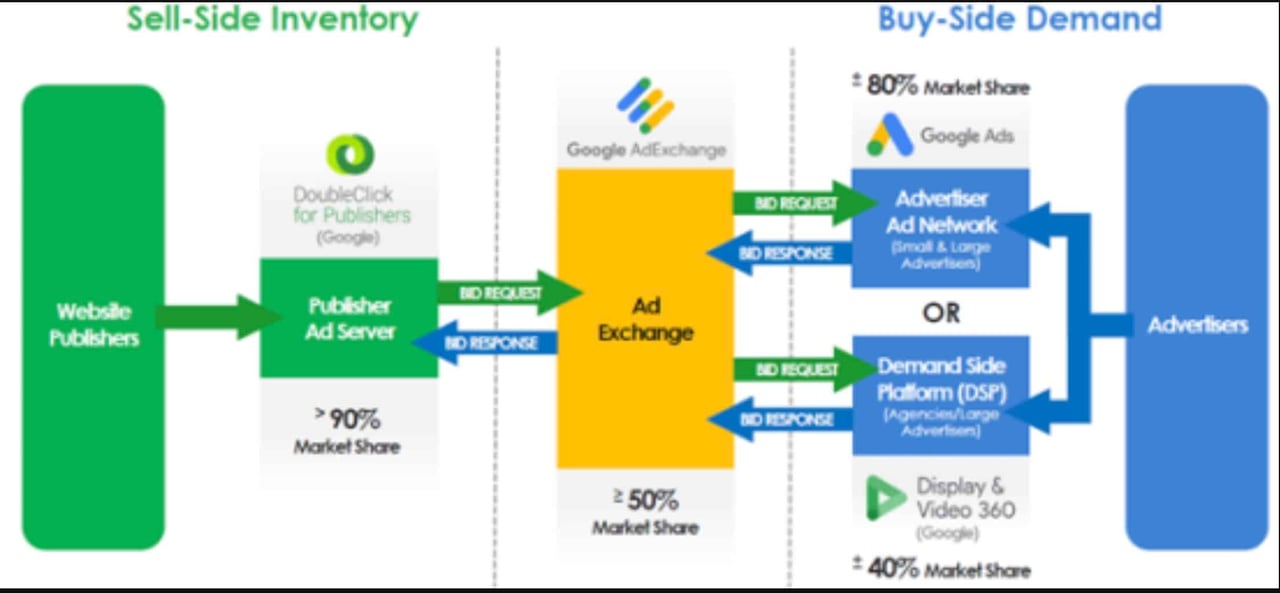

Alleging violations of the federal Sherman Antitrust Act, the 153-page complaint says Google has made itself calculatingly omnipresent in the digital ad market, unlawfully controlling all aspects of buying, selling and exchange services between advertisers and publishers.

“Google abuses its monopoly power to disadvantage website publishers and advertisers who dare to use competing ad tech products in a search for higher quality, or lower cost, matches,” says the complaint, which was joined by California, New York, Virginia and five other states. “Google uses its dominion over digital advertising technology to funnel more transactions to its own ad tech products where it extracts inflated fees to line its own pockets at the expense of the advertisers and publishers it purportedly serves.”

The government seeks an injunction that would prevent Google from continuing to engage in anticompetitive practices, noting that the actions the company has taken have resulted in increased costs for both businesses and the U.S. government, including its military.

Assistant Attorney General Jonathan Kanter added Tuesday at the press conference that Google’s actions “had and continues to have the effect of driving out rivals diminished competition, inflating advertising costs, reducing website publisher revenues, stymieing innovation and flattening our public marketplace of ideas.”

Among other points, the complaint details Google’s patterns of locking in content creators through tying arrangements; giving itself a first look and last look advantage over competing ad exchanges at auctions; and blocking industry participants from using rivals’ technology.

“Because Google dominates every part of the ad tech industry, it has the power to impose a surcharge on display advertising transactions in an industry where billions of dollars are transacted via instantaneous auctions each year in the U.S.,” Kanter said. “Google's own documents estimate that it keeps on average at least 30 cents of each advertising dollar that flows through Google's ad tech tools for some transactions. For certain customers, Google keeps significantly more.”

A Google spokesperson responded to the filing Tuesday, saying the government “is doubling down on a flawed argument that would slow innovation, raise advertising fees, and make it harder for thousands of small businesses and publishers to grow."

“Today’s lawsuit from the DOJ attempts to pick winners and losers in the highly competitive advertising technology sector,” the spokesperson continued on behalf of the company, which in 2021 earned $209 billion in advertisement revenue, or 81% of its total profit.

Federal officials say Google, a subsidiary of Alphabet Inc., has sought to control so much of the digital advertising industry with the goal of becoming “the be-all, and end-all location for all ad serving." Compounding its “outsized influence,” according to the complaint, maintaining a “dominant position on both sides of the industry would give Google the ability to charge supracompetitive fees and also enjoy an abiding dominance sufficient to exclude rivals from competition.”

Some evidence of Google’s anticompetitive conduct detailed in the complaint include its control of the technology used by nearly every major website publisher to offer ad space; its control of the leading tool used by advertisers to buy that space; and its control of the largest ad exchange that matches publishers and advertisers together.