LOS ANGELES (CN) — Video game giant Activision Blizzard has agreed to pay $35 million in a settlement with the Securities and Exchange Commission over claims it lacked adequate disclosure controls for assessing reports of workplace misconduct.

The SEC said Friday that Activision agreed to settle allegations that it failed to maintain internal procedures among its separate business units to collect and analyze employee complaints of workplace misconduct. As a result, its management didn't have a sufficient grasp on the volume and substance of such complaints to assess whether, as a publicly traded company, it needed to inform investors there was a potential risk attracting and retaining employees.

In addition, the Santa Monica, California-based company settled a separate allegation that it violated a whistleblower protection rule by requiring former employees to tell the company if they received a request for information from the SEC.

The company didn't admit fault as part of the settlement.

"We are pleased to have amicably resolved this matter," Activision said in a statement. "As the order recognizes, we have enhanced our disclosure processes with regard to workplace reporting and updated our separation contract language. We did so as part of our continuing commitment to operational excellence and transparency. Activision Blizzard is confident in its workplace disclosures.”

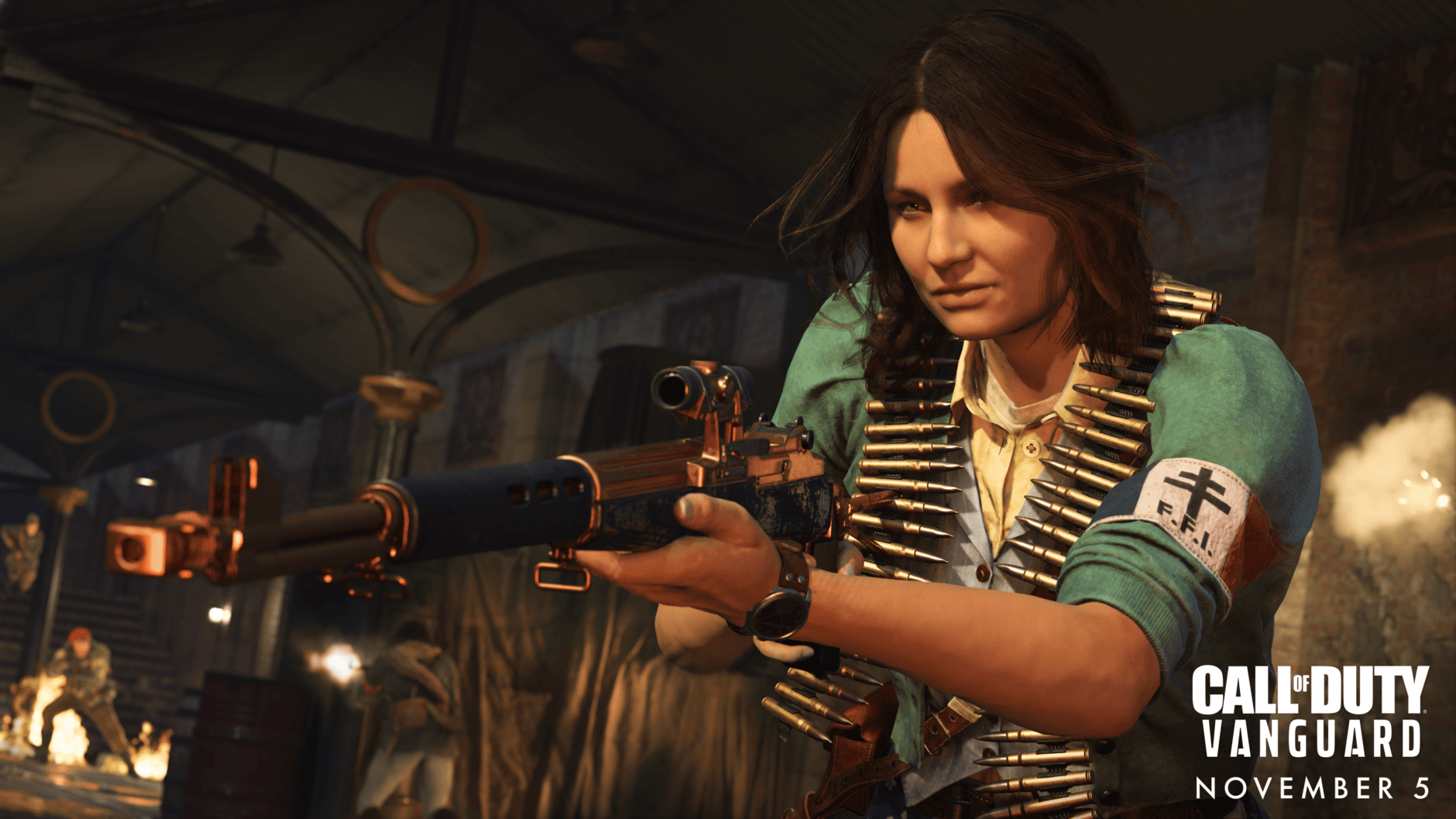

The publisher of the Call of Duty and World of Warcraft franchises, among other video games, has been contending for the last two years with the fallout from reports that sexual harassment and discrimination was rampant at its studios.

The company was sued in 2021 by the California Department of Fair Employment and Housing, which claimed the company had fostered a pervasive "frat boy" workplace and had created a breeding ground for harassment and discrimination against women. Activision's initial denial of the allegations prompted its employees to walk out.

Last year, the company settled a lawsuit by the U.S. Equal Employment Opportunity Commission over allegations of sexual harassment for $18 million. California had objected to the settlement, saying it gave Activision leverage to walk away cheaply from the sexual harassment and discrimination claims under the state's laws, which are far more protective of workers than federal law. The California lawsuit remains pending.

In the SEC case, the commission claimed Activision was aware that its ability to attract, retain, and motivate employees with the specialized skills to create and sell its video games was a particularly important risk in an industry where there is a high level of employee mobility, competitive compensation programs, and aggressive recruiting among rivals. Nevertheless, the SEC said, Activision didn't collect and analyze complaints about workplace misconduct to determine whether they amounted to a risk it had to share with investors.

“The SEC’s order finds that Activision Blizzard failed to implement necessary controls to collect and review employee complaints about workplace misconduct, which left it without the means to determine whether larger issues existed that needed to be disclosed to investors,” Jason Burt, director of the SEC’s Denver Regional Office, said in a statement. “Moreover, taking action to impede former employees from communicating directly with the Commission staff about a possible securities law violation is not only bad corporate governance, it is illegal.”

Last month, Activision defeated a lawsuit by shareholders who claimed the video game maker's board of directors failed for years to remedy discrimination against women employees even though they had been made aware of the illegal hiring and pay practices.

U.S. District Judge Percy Anderson in Los Angeles dismissed the shareholders' third attempt to jump the hurdle that requires them to explain why they didn't directly demand the board to fix the problem, as the law requires, before suing. Anderson didn't allow the shareholders to remedy their complaint a fourth time and closed the case.

Subscribe to Closing Arguments

Sign up for new weekly newsletter Closing Arguments to get the latest about ongoing trials, major litigation and hot cases and rulings in courthouses around the U.S. and the world.