BUENOS AIRES, Argentina (CN) — Argentina’s tourism sector is revving back up after pandemic-induced border closures halted the industry, as its depreciating local currency makes the nation an attractive destination for millions of foreign visitors.

The South American nation hosted 410,000 tourists in October, the highest number since its borders reopened one year ago as the tourism industry continues to climb back to pre-pandemic levels. So far this year, 2.9 million international tourists have visited Argentina, the number one destination in South America after Brazil and Chile.

“The challenge of the moment is to reach pre-pandemic levels of international tourism and we are close to achieving that,” Matías Lammens, minister of tourism and sports said, thanks to “the strong recovery of connectivity in the last few months as a result of the return of many airlines, the arrival of new companies and the firm commitment to inbound tourism that Aerolíneas Argentinas [the country’s flag carrier] is carrying out.”

The acceleration of inbound tourists “places the country as a regional leader in recovery levels,” Lammens said, adding that “tourism led the numbers of job creation and economic growth in the first half of the year, and we’re convinced that… it will be a determining sector for the economic development of the coming years.”

But Argentina is mired in a deep economic crisis. More than a third of the population lives in poverty. Its Central Bank is losing reserves that are needed to pay back a $44 billion IMF loan. And inflation topped 88% over the last 12 months — one of the highest levels in the world.

One supply source for the Central Bank to shore up its depleting international reserves is to collect foreign currencies from inbound tourists, who bring with them U.S. dollars, Brazilian reais and euros. The Argentine government estimates foreign visitors have spent $2.32 billion U.S. dollars since the beginning of 2022.

“The level of spending by foreign tourists is already at pre-pandemic figures and we aim to close the year with a very high level of tourist arrivals, both from the region and from more distant countries such as the United States, Spain and France," Lammens said.

The critical issue for the government, however, is that only a fraction of foreign currencies that are brought into Argentina enters the official foreign exchange market and gets channeled into the Central Bank reserves. The majority of tourists that enter the world’s eighth largest country — whether they come to experience the culturally rich capital of Buenos Aires or taste wine among the Andes of Mendoza — bring cash and exchange it on the black market, where they can find rates much better than the official exchange rate.

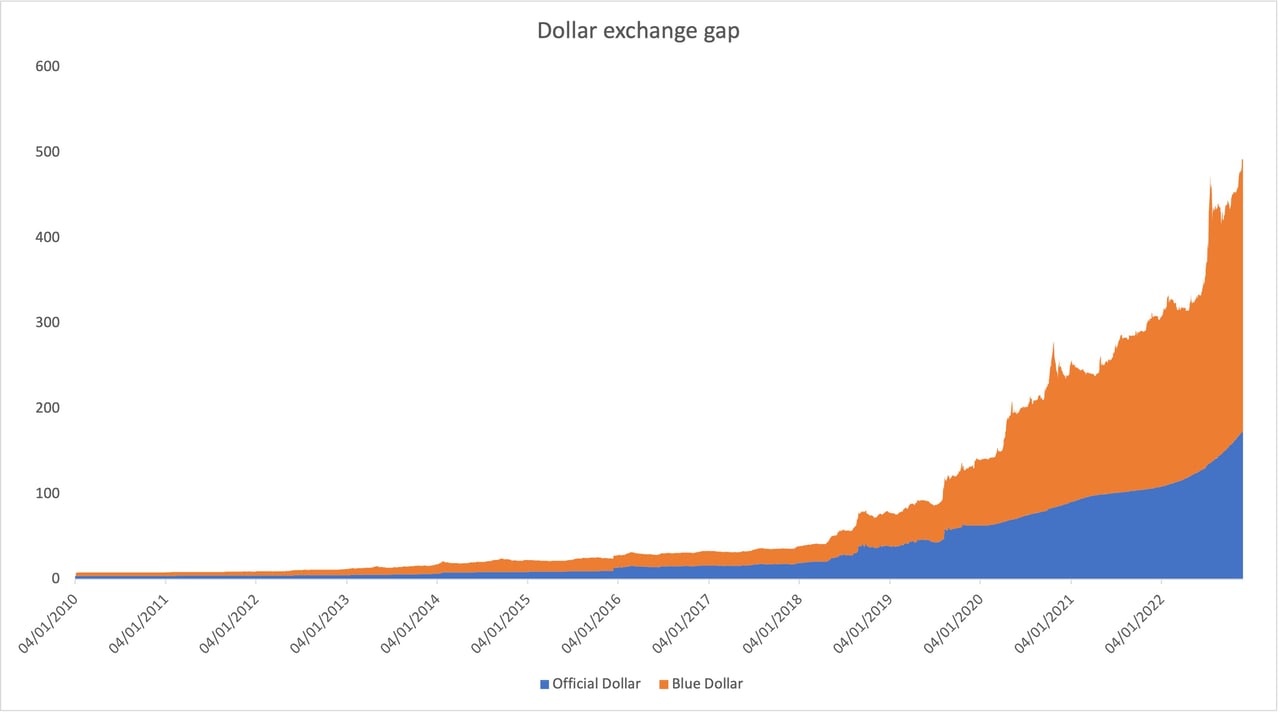

Currently, the official dollar exchange rate is $174 pesos. For tourists using a debit or credit card, this is the rate that is charged. Outside of government control on the flourishing illegal market, the rate $314 pesos.

The government estimates that among the $2.32 billion U.S. dollars spent by foreign tourists this year, only 14% has come through the official exchange. For those that opt for the black market, the number one destination is downtown Buenos Aires, on Florida Street.

The pedestrian street is a major shopping and tourist area, bustling with shoppers, street performers, city workers and vendors. Scattered along the half-mile street are also the arbolitos, ‘little trees’ — illegal money changers who line the pavement like the trees along the sidewalk.

The arbolitos sell pesos at the unofficial rate, although the transaction doesn’t take place out in the open. Once an exchange is agreed, the arbolito leads the buyer to an underground exchange house called a cueva, or cave. This may be at the back of a kiosk, a tourist agency or an office. The arbolitos receive a commission by the caves once a transaction is completed.

“The parallel foreign exchange market has a long history in the local economy,” said María Sánchez, a sociologist who investigates financial markets in Argentina. “In the last two decades, the illegal purchase and sale of dollars acquired renewed economic and political relevance.”

The pandemic hit the illegal exchange market like the rest of the national economy. The constant supply of buyers disappeared as Buenos Aires entered the longest continuous lockdown in the world. The sea of pedestrians circulating on Florida Street dried up as downtown became desolate.

“The street was dead,” said one arbolito who didn’t want to be named. “There was no tourism, no commerce, no people walking around.” Many began to uproot from Florida Street and provide delivery services arranged on social media and word of mouth to maintain clients.

In Argentina, there are multiple types of dollar exchanges. There is one type of dollar for exporters, one for wholesalers, one for purchases of goods and services outside of Argentina, such as streaming platforms. The blue dollar is what’s exchanged on the black market.

The government currently restricts the individual purchase of dollars to $200 per month, which also comes with two separate taxes of 35% and 30% added on. This generates strong demand for the blue dollar and is why many locals head to the black market to convert their ever-depreciating pesos into dollar savings.

As Argentina gears up to enter the peak tourist season, from December to February, the government has been enticing international tourists to spend their dollars at the official rate. Last year it launched a special bimonetary account with a better exchange rate for tourists to use for purchases made in the country. Yet in June 2022, the government revealed that not a single account had been opened.

In a second attempt to entice international tourists into the official market, the Central Bank recently declared that tourists will have access to a more favorable exchange rate when they make purchases with foreign debit and credit cards. Instead of being charged at the official rate of $174 pesos, they will now be worth roughly the same as the blue dollar, $315 pesos.

The launch was set for the beginning of November, but operational issues set this back by one month. The Central Bank hopes the special exchange rate for tourists will begin Dec. 2.

Courthouse News correspondent James Francis Whitehead is based in Buenos Aires, Argentina.

Subscribe to Closing Arguments

Sign up for new weekly newsletter Closing Arguments to get the latest about ongoing trials, major litigation and hot cases and rulings in courthouses around the U.S. and the world.