WASHINGTON (CN) — Hours after Senate Democrats voted to raise the debt ceiling Tuesday, their colleagues in the House voted along party lines early Wednesday morning to do the same in a move that narrowly avoids a default on the nation's debt.

By a vote of 221-209, the House passed the legislation on to President Joe Biden’s desk with Democrats acting alone to raise the limit on how much money the country can borrow.

The bill raises the debt ceiling by $2.5 trillion, a substantial hike that is estimated to fund legislation through 2023, according to Senate Majority Leader Chuck Schumer.

The House vote came minutes after midnight on Wednesday, the day the country was expected to hit its borrowing limit if Congress did not raise the borrowing threshold.

“No brinkmanship, no default on the debt, no risk of another recession. Responsible governing has won on this exceedingly important issue," Schumer said on the Senate floor Tuesday. "The American people can breathe easy and rest assured there will not be a default.”

Democrats were able to push the legislation through the starkly divided Senate Tuesday and on through the House thanks to a bipartisan deal reached last week between Senate Minority Leader Mitch McConnell and Democratic leaders to make a one-time change to lower the number of votes required to pass the legislation.

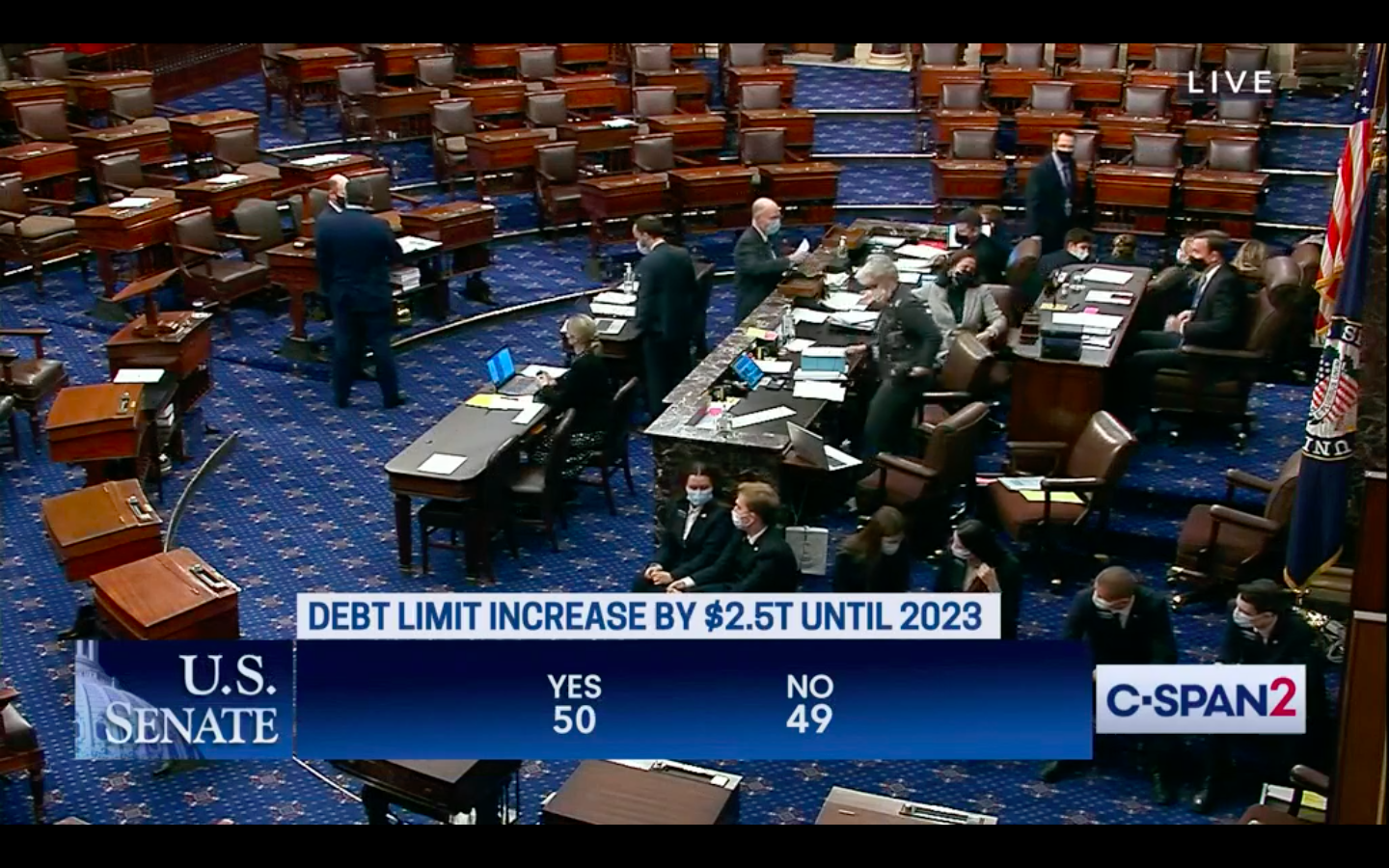

Instead of needing the 60 votes typically required to avoid a filibuster and pass legislation in the Senate, the plan allowed for Democrats to go it alone with a simple majority vote of 50–49 to raise the debt limit.

The agreement also forced Democrats to specify the amount the limit would be raised by instead of suspending the ceiling entirely for a given amount of time as Congress has done in recent years.

Until now, this Congress has relied on short-term measures to get by, passing a two-month increase to the debt limit back in October, as it was unable to bridge partisan divisions over the debt and voted on temporary legislation simply to avoid an economic calamity.

The compromise provided Democrats a way to raise the limit and avoid economic disaster while Republicans also avoided a recession without having to carry the potentially politically damaging baggage of appearing to support government spending.

McConnell blamed Democrats for the increase in the debt limit, arguing that the pending Build Back Better Act and historically large legislation such as the president's recently passed $1.2 trillion infrastructure bill could damage the economy.

"If they jam through another reckless taxing-and-spending spree, this massive debt increase will just be the beginning, more printing and more borrowing to set up more reckless spending to cause more inflation to hurt working families even more. What the American people need is a break," McConnell said on the Senate floor Tuesday.

Schumer said the debt limit hike was not the result of spending by one party, noting that it includes payments racked up by legislation passed under the Trump administration.

“This is about paying debt accumulated by both parties,” Schumer said.

House Majority Leader Nancy Pelosi said the limit increase was necessary to avoid economic repercussions.

“The full faith and credit of the United States should never be questioned. The health of our economy should never be threatened. The financial security of our families must never be gambled,” Pelosi said on the floor of the House Tuesday.

Subscribe to Closing Arguments

Sign up for new weekly newsletter Closing Arguments to get the latest about ongoing trials, major litigation and hot cases and rulings in courthouses around the U.S. and the world.