(CN) — Just one day after facing a groundbreaking suit over fiduciary duty, the stock-trading app Robinhood Financial reached a federal settlement Thursday over a practice said to have cost customers tens of millions of dollars.

The Securities and Exchange Commission went after Robinhood over a controversial practice called “payment for order flow” that allegedly has led users to pay more for stock they buy — and get less money for stock they sell — than they otherwise would have.

Undercutting the value of its commission-free trading system, Robinhood uses payment for order flow so that stock orders are routed to companies willing to compensate it for the work rather than the companies that offer the best available prices.

Robinhood didn’t admit or deny the charges in reaching a $65 million settlement with the SEC memorialized in a 16-page order.

The deal comes at a particularly embarrassing time for the Delaware-based company inasmuch as it hired Goldman Sachs just last week to lead an IPO next year that could value the business at more than $20 billion.

Both the SEC and FINRA are continuing to investigate the company for its 70 system outages this year, including one that lasted all day on March 2 when the Dow Jones Industrial Average had its largest point gain in history.

On Wednesday meanwhile, Massachusetts brought a state suit against the company for failing to protect investors from unsuitable trades and not having sufficient infrastructure to prevent frequent

The Massachusetts complaint accuses Robinhood of deliberately seeking more customers even though it knew that its infrastructure couldn’t keep up with its needs. It also claims that Robinhood used gimmicks to encourage investors to trade incessantly without any regard for the suitability of the trades.

In one case, “Robinhood allowed a customer with no investment experience to make more than 12,700 trades in just over six months,” the complaint says.

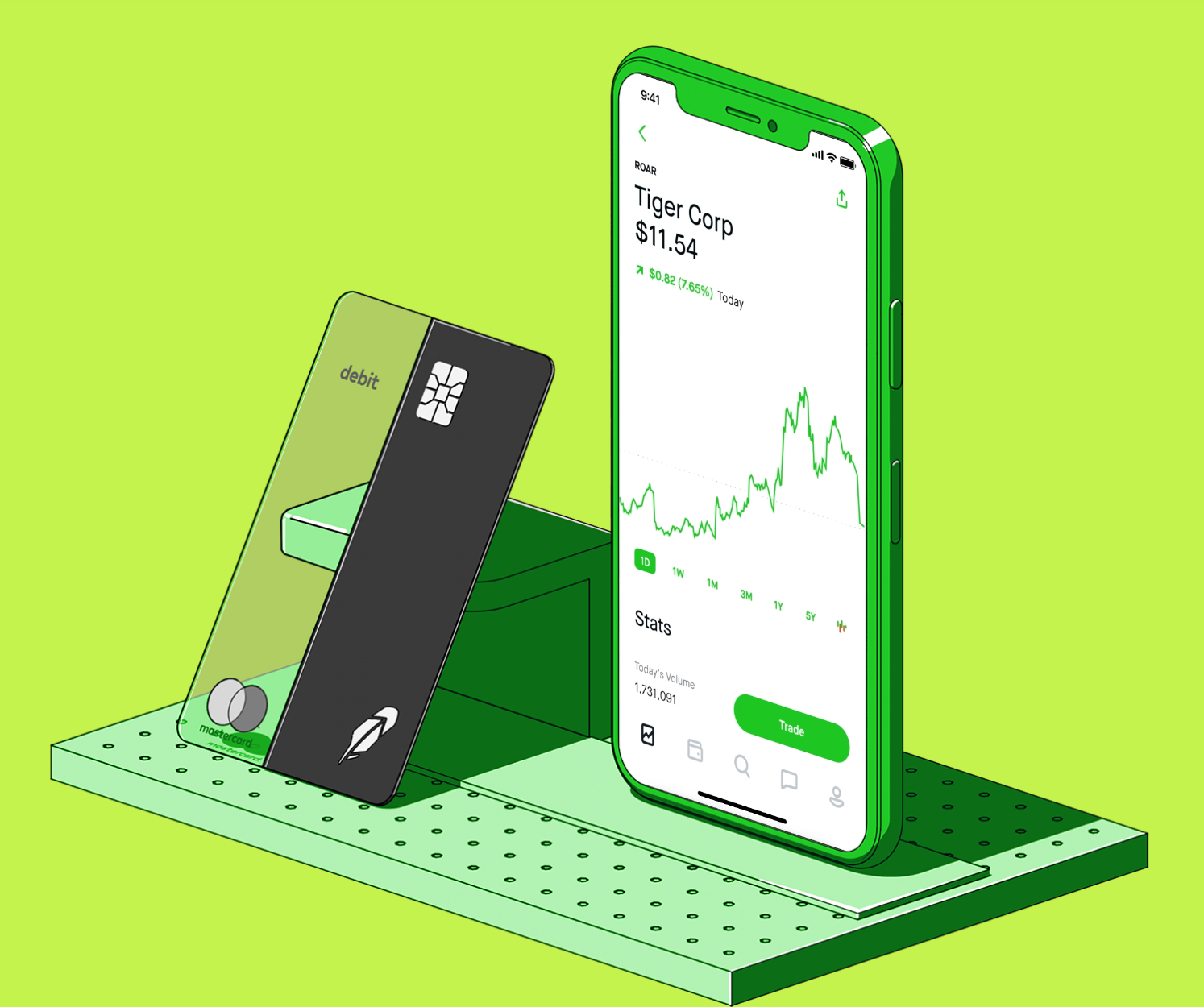

Popular with millennials, the company was founded in 2014 by two former Stanford roommates, Baiju Bhatt and Vlad Tenev, and experienced exponential growth, reaching 13 million customers this year. Unlike many brokerages that seek an older and more affluent clientele, Robinhood deliberately targets millennials and tries to make investing seem like playing a video game.

The median age of Robinhood investors is only 31 and many are inexperienced and unsophisticated. The app-based business was valued at $5.6 billion in a 2018 funding round.

“Tech companies often believe that because they are innovative they operate outside existing rules,” said Quinn Curtis, who teaches securities and venture capital at the University of Virginia School of Law.

“But just like Uber has to grapple with taxi and labor laws from a different era, Robinhood has to navigate the rules that apply to brokers,” Curtis said in an interview.

Robinhood offers commission-free trades and makes money through interest on accounts, margin lending and premium products.

But the SEC says most of its profits have come from payments for order flow.

The SEC nearly outlawed payments for order flow in the 1990s, and while the practice is still legal brokers are required to disclose it. Robinhood allegedly not only didn’t disclose it but affirmatively misled investors in its FAQs by saying that customers got executions that were as good as or better than those of its competitors.

The government was especially concerned in this case because Robinhood’s investors tend to be novices, according to Charles Whitehead, a professor of securities law at Cornell Law School.

The SEC “views itself as a consumer protection agency,” Whitehead said. “When you talk about unsophisticated investors, that’s what the SEC focuses on. They’re there to protect mom and dad.”

In a statement on its website, the SEC says “Robinhood provided inferior trade prices that in aggregate deprived customers of $34.1 million even after taking into account the savings from not paying a commission.”

Late last year Robinhood paid a $1.25 million fine to the Financial Industry Regulatory Authority for similar violations.

The new SEC settlement “relates to historical practices that do not reflect Robinhood today,” the company’s chief legal officer, Dan Gallagher, said in a statement. “We recognize the responsibility that comes with having helped millions of investors make their first investments, and we’re committed to continuing to evolve Robinhood as we grow to meet our customers’ needs.”

Gallagher was an SEC commissioner from 2011 to 2015.

Subscribe to Closing Arguments

Sign up for new weekly newsletter Closing Arguments to get the latest about ongoing trials, major litigation and hot cases and rulings in courthouses around the U.S. and the world.