BUENOS AIRES (CN) — Argentina’s lower house has approved the national budget for 2023 after a midnight marathon session that included 100 speakers.

The Chamber of Deputies voted for the draft budget by 180 to 22 with 49 abstentions – despite the opposition holding a majority in the lower house — and will now go to the government-controlled upper house. The small liberal and socialist blocs rejected the budget.

Last year’s draft budget failed to get through Congress, the first time to happen in Argentina since its return to democracy in 1983, forcing President Fernández to extend and update the previous budget.

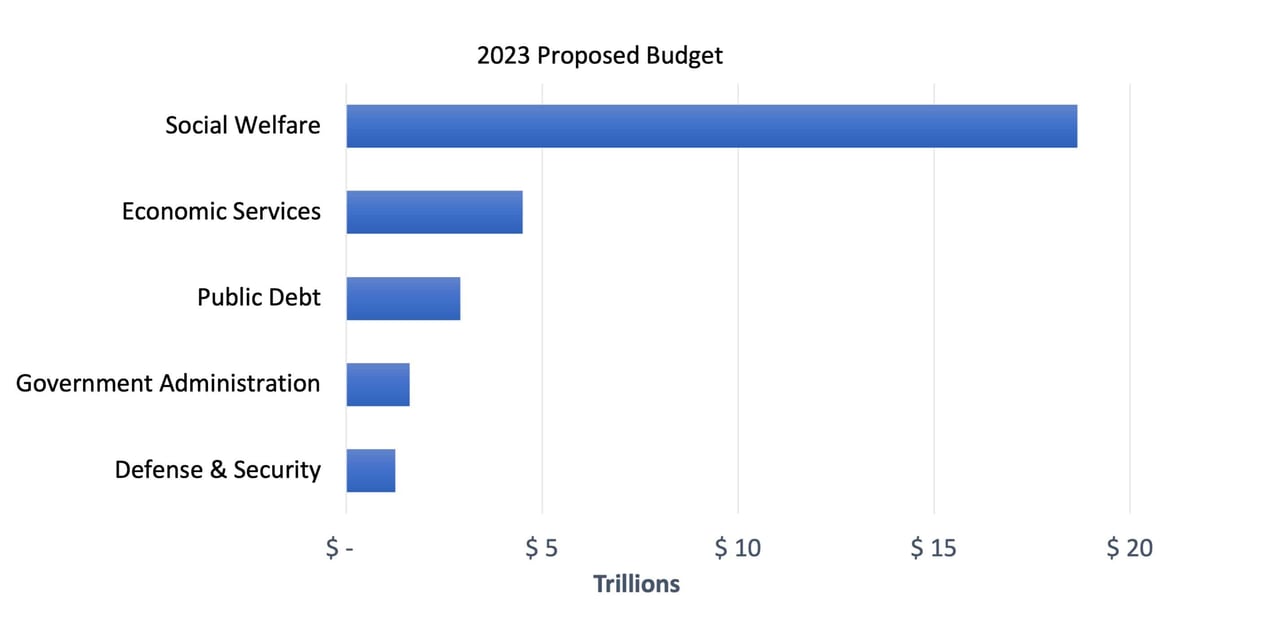

The core of the 2023 budget is a total spending of $29 trillion pesos ($183 billion U.S. dollars), GDP growth of 2% and a reduction in the fiscal deficit from 2.5% to 1.9% — a target set by the IMF and a condition for the global lender’s $44 billion loan to the South American nation.

Despite the budget representing a real terms increase of 1.6% on this year’s budget, there are cuts to healthcare (3.2%), housing (9.2%), children and adolescents (2.4%), education (9%) and the environment (12%).

“The budget proposes a moderate decrease in the fiscal deficit, although the assumptions on which it’s based aren’t only in terms of macroeconomic projections, such as GDP, inflation, and monetary financing, but also in relation to the fact that in order to achieve the proposed objective, the evolution path of the same macroeconomic variables would have to be altered,” said Darío Rossignolo, an economist and public finance expert.

The budget forecasts inflation to reach 60% next year — despite independent analysts and observers putting the figure in triple digits. “The budget’s inflation projection is indeed optimistic,” added Rossignolo, “not only in relation to the forecasts of consulting firms but also because it doesn’t propose consistent fiscal policies to reach this inflation target.”

Despite the government’s budget being passed in the lower house, one of the biggest national talking points was an article that was voted down.

The lower house rejected a bill to end an income tax exemption for judges and judiciary workers, the origins of which are founded in the national constitution that dates back to 1854. Article 110 states that “the Justices of the Supreme Court and the judges of the lower courts of the Nation” shall receive renumeration “which shall not be diminished in any way while holding office.”

This was first tested in 1936 when the Supreme Court ruled an income tax on federal judges unconstitutional in the case of the National Treasury v. Rodolfo Medina, declaring that the tax exemption ensured the independence of the judiciary with respect to the other state powers.

The proposed 2023 budget had expected to bring in $238 billion pesos from taxing judges, prosecutors and judicial officials, approximately 0.16% of GDP. That is more than the annual budget of the Ministry of the Interior and the Ministry of Justice and Human Rights.

An association for magistrates issued a statement prior to the vote in which it expressed its rejection of the article that “aims once again to violate the constitutional clause.”

Judges in Argentina are currently paid one million pesos per month on average, with Supreme Court judges earning between 1.7 and 2.4 million pesos. The average wage of registered workers in Argentina is around 155,000 pesos. However, the nation's labor market suffers from long-term informality. Currently, 36% of the workforce are informal laborers. And the pandemic has deepened people’s dependence on precarious work, with 80% of job recovery generated in the informal market.

“Firstly, Article 110 doesn’t mention the workers or employees of the judiciary, but only the judges,” said Rossignolo. “In addition, Article 16 states that ‘there are no personal privileges or titles of nobility. All its inhabitants are equal before the law.’ And that ‘equality is the basis of taxation.’ This means that there is no reason why there should be people who do not pay the tax.”

After the amendment failed, President Fernández said in a radio interview, “it is incomprehensive that judges do not pay income tax. I as president earn just over 500,000 and I pay income tax.”

In 2016, during the center-right administration of Mauricio Macri, Congress passed a grandfather clause in which all judges, prosecutors and judicial officials appointed after Jan. 1, 2017, would begin to pay income tax. Yet those appointed before then continue to benefit from the tax exemption.

Rossignolo believes that this amendment partly explains why the current government’s bill was rejected. “Also, from a certain political alternative,” he said, “it was decided to address the issue with some consensus with those affected [judges and judiciary officials] and not from an article in the budget, which probably would have generated presentations and eventual rulings to the contrary by the judges themselves.”

There is no personal income tax in Argentina, so governments rely on collecting an alternative tax called impuesto a las ganancias, technically a type of tax on profits that includes income above a certain threshold — currently set at 330,000 pesos per month (around $2,100 U.S. dollars).

This restricts income tax contributions to formal employees that make double the national average. In 2021, income tax made up just 14.7% of national tax revenue, with the government’s largest revenue source, VAT, making up 35.9% of total national income.

Despite income tax being paid by a small percent of the better-paid workforce, it generates strong opposition — even among the socialists. Nicolás del Caño, a Workers’ Left Front deputy warned against the bill.

“Beware that behind the payment of income tax by judges, which is something that we agree with, it includes the workers of the judiciary,” he said. “From there, they’re looking to tax as many as possible so that the adjusted budget ordered by the IMF is met. Wages are not profit."

Rossignolo believes that the strong opposition likely stems from the way the law was drafted.

“Unlike other countries, the tax is called ‘a las ganancias’ instead of ‘income,’ thus giving rise to confusion,” he said. “This is used by certain groups like trade unions and the government to compensate wage increases below inflation with increases in the minimum rate of income tax, to sustain the purchasing power of wages.”

The approved 2023 budget is expected to be debated in the Senate this week, without reform of the judiciary tax exemption.

“Income tax should be levied on all income,” said Rossignolo, “regardless of whether it is salary, pensions, self-employment income or capital income — although in Latin America, the scope of income tax has only recently been extended.”

Subscribe to Closing Arguments

Sign up for new weekly newsletter Closing Arguments to get the latest about ongoing trials, major litigation and hot cases and rulings in courthouses around the U.S. and the world.