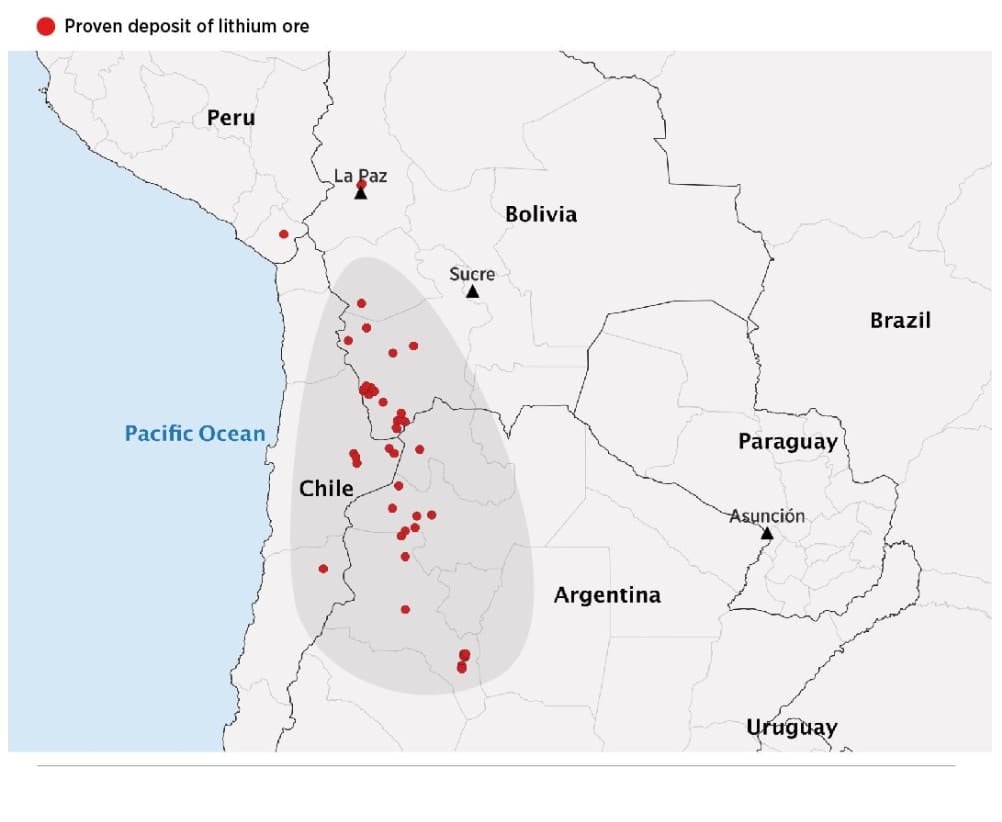

(CN) — Latin America’s new wave of left-wing governments is increasing regional cooperation between the countries of the lithium triangle, an area home to the world’s largest lithium reserves, the white mineral fueling a new era of clean energy.

As global demand for the so-called ‘white gold’ increases, so does the potential regional power of Argentina, Chile and Bolivia — the lithium triangle countries that share a 154,000 square mile area roughly the size of the state of California.

Since the leftward swing across Latin America beginning in 2018, there has been rising expectations when it comes to developing domestic lithium industries as well as regional cooperation in mining and production.

"Argentina has the second largest lithium reserves in the world,” said Argentina President Alberto Fernandez during a visit to the country’s first lithium battery manufacturing plant on Aug. 16. “We not only have to export it, but also industrialize it. I have seen how the world demands lithium as an energy source and I believe we have the opportunity to provide it."

Speaking next to the president, the minister of science Daniel Filmus highlighted the regional role of the lithium triangle. "We are pioneers in the region in this type of development and, at the same time, we are working jointly with Bolivia and Chile, which, together with Argentina, account for more than 60% of the world's lithium reserves,” said the minister.

“We will soon be holding a working meeting in Bolivia to discuss how we can carry out technology transfer projects to strengthen exports of value-added products,” added Filmus.

Argentina and Chile have already begun holding bilateral talks on deepening long-term economic ties and laying the foundations for lithium production chains at the regional level.

In June, Argentina and Chile held their first joint lithium and salt flats working group, addressing not only cooperation in mineral extraction but also the importance of environmental and social issues connected to the industry.

The vast salt flats of the Andean region hold huge potential for exploitation, where lithium concentration can reach hundreds of milligrams per liter. These basins have stored water for thousands of years, accumulating rich minerals carried from mountain slopes. Lightweight and capable of high energy storage, lithium is a core component of rechargeable batteries, powering not only cellphones and computers but also fueling green energy like solar and wind power as well as electric vehicles.

The lithium triangle is home to around 65% of the world’s lithium ore reserves, yet the industry remains broadly underdeveloped across the region. Currently, only Chile is a core country in the global supply chain along with Australia and China.

Last year, 100,000 tons of lithium was mined globally. Australia was the top producer, mining 55,000 tons. Chile followed in second place, mining 26,000 tons, with China digging up 14,000 tons.

Revved up by rising consumer appetite and reinvigorated by government incentives, demand for lithium is set to reach 2.4 million tons by 2030. To accommodate this, new supply chains need to be built in order to match demand. If not, the transition to cleaner forms of energy and transport will be weighed down by production setbacks and high prices.

This scenario is currently playing out. As the global economy reconnects during the pandemic recovery, supply chain pains have pushed up prices of everything from consumer goods to production costs. With demand running ahead of supply, the price of lithium has hit a record high of $75,000 per metric ton — an increase of more than $65,000 since 2020 — as companies such as Tesla and Volkswagen struggle to plug in lithium supplies.

Accelerating the growth of global supply centers can help to rebalance the marketplace. Yet for two sides of the lithium triangle, Argentina and Bolivia, the lithium industry remains underrealized and underdeveloped, but greater investment is being pumped into the sector.

Much of that is coming from China, the world’s primary electric vehicle market, which has invested more than $16 billion in lithium mining projects across Argentina, Chile and Bolivia.

Argentina, which holds around 21% of the world’s lithium reserves, expects around $4 billion in investment over the next half a decade as it aims to double production — with much of this development tied to Beijing-backed projects.

Bolivia’s lithium industry is the least developed of the three Andean nations yet holds the highest potential. The country is sitting on the world’s largest white gold reserves of 21 million tons but has so far been unable to realize its potential. To accelerate development, Bolivia is weighing up multiple offers from foreign firms — including from the U.S. and China — to exploit the mineral.

Deepening regional relations, state-owned companies from Bolivia and Argentina have already set foundations for cooperation in the industry. Bolivia’s lithium development company, Yacimientos de Litio Bolivianos, signed an agreement on Aug. 4 with Argentina’s oil and gas company Y-TEC to produce lithium-ion batteries.

Lithium’s role of powering the globe’s green revolution is also unearthing social uneasiness and environmental concerns.

Protests have filled the streets across Chile and Bolivia in recent years in response to government plans to hand out contracts to foreign companies, fearing profits will be channeled out of the region and leaving behind no benefits for the local communities that share the arid landscape with the vast salt flats of the Andes.

The Andean salt flats stretch out across fragile ecosystems. The process of extracting lithium involves pumping brine with a large volume of fresh water that can deplete groundwater reserves, affecting access to fresh water for communities around the Andes and their farming livelihoods.

Although currently politically aligned, the governments of Argentina, Chile and Bolivia face multiple challenges to accelerate lithium production and strategically position themselves in the global supply chain. The uneven development across the region, the level of state versus corporate control, the role of China and the potential environmental harm from inefficient practices are all pending issues that need to be resolved if the lithium triangle can realize its regional power and become a key part of the global revolution in clean energy.

Subscribe to Closing Arguments

Sign up for new weekly newsletter Closing Arguments to get the latest about ongoing trials, major litigation and hot cases and rulings in courthouses around the U.S. and the world.